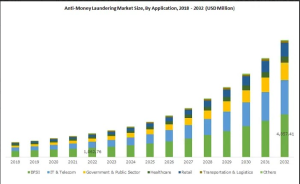

The Know Your Customer (KYC) and Anti-Money Laundering (AML) landscapes are rapidly changing as new technologies and criminal strategies develop. Regulators throughout the world are trying to adjust regulatory frameworks to keep up with these changes, balancing the need to protect financial institutions while also encouraging innovation. This article delves into cutting-edge innovations in KYC/AML, the companies leading the way, the most recent legislative developments, and how these trends are shaping the future of financial compliance around the world. The global market for Anti-Money Laundering (AML) Solutions is expanding at an unprecedented rate, expected to reach $11.9 billion by 2030.

Importance Anti Money Laundering And KYC

The fundamental goals of Know Your Customer (KYC) and Anti-Money Laundering (AML) laws are to prevent or lessen the effects of financial crime, including corruption, money laundering, and financing of terrorism. For regulated organizations judged to be highly susceptible to aiding financial crime, KYC and AML are required. Alright, let’s begin with money laundering. Firstly, the annual cost of money laundering is estimated to be between 3% and 5% of the world GDP, or over $2 trillion! The act of passing off the proceeds of illicit activity as lawful financial resources is known as money laundering. Criminals can use it to “clean” their illicit funds and make them appear to have originated from a reliable source. Not only can drug dealers and mafia bosses engage in money laundering, but corrupt politicians, terrorists, and people smugglers can also be engaged.

Why Choose Anti Money Laundering And KYC Course

These regulations aim to stop criminal groups from money-laundering through the financial system. Analyzing customer data is a difficult and time-consuming step in the AML compliance process. The identification of clients who turn to illicit means of cleaning their ill-gotten wealth is the focus of anti-money laundering (AML). Knowing an institution’s clientele well is, thus, the first and most effective mitigating element. The Customer and KYC Course. An extensive course that covers best practices and regulatory requirements for setting up reliable KYC procedures. The key elements of a successful KYC program, including as customer identification, verification processes, risk assessment, and continuous monitoring, will be covered in this course. You’ll comprehend the need of maintaining correct records, providing appropriate documents, and following anti-money laundering (AML) guidelines in the KYC procedure.

Career Growth in Anti-Money Laundering And KYC Course

The future opportunities for a career in AML-KYC are vast, as breakthroughs in technology such as Artificial Intelligence and Machine Learning are expected to alter automation and digitization of operations and customer experience. A job in KYC-AML can provide exciting chances for advancement, stability, and the possibility to have a beneficial impact on society. The Bureau of Labor Statistics projects that between now and 2028, there will be a 6% increase in the number of financial analysts, including analysts who specialize in money laundering prevention. This growth rate is comparable to job outlooks for other occupations.

The future opportunities for a career in AML-KYC are vast, as breakthroughs in technology such as Artificial Intelligence and Machine Learning are expected to alter automation and digitization of operations and customer experience. A job in KYC-AML can provide exciting chances for advancement, stability, and the possibility to have a beneficial impact on society. The Bureau of Labor Statistics projects that between now and 2028, there will be a 6% increase in the number of financial analysts, including analysts who specialize in money laundering prevention. This growth rate is comparable to job outlooks for other occupations.

CURRICULUM

Introduction to AML & KYC

- A Synopsis of Terrorist Financing and Money Laundering

- The value of KYC and AML

- Frameworks for Law and Regulation

- International Rules and Regulations

- Important Phrases and Ideas

AML Compliance Programs

- Creating a Successful AML Program

- Due Diligence for Customers (CdD)

- Increased Inquiry (EDD)

- Tracking Transactions

- Reporting Unusual Behavior

KYC Processes and Procedures

- KYC Records and Confirmation

- Risk-Based Method for KYC

- Initial Setup and Continued Surveillance

- Determining the Beneficial Ownership

- KYC in Remote and Digital Environments

Case Studies and Practical Applications

- Actual Case Studies

- Industry-Recommended Methods

- AI and machine learning technologies in AML and KYC

- Issues and Solutions with Compliance

- Final Project and Models