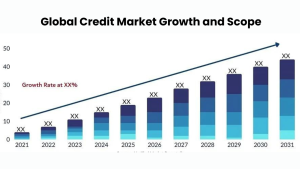

The course “Future of Credit” examines how credit is changing in the digital era. It discusses how credit scoring and lending processes are affected by fintech advancements, blockchain technology, and artificial intelligence. Peer-to-peer lending, big data analytics in credit risk assessment, and decentralized finance (DeFi) are just a few of the cutting edge concepts that will be covered for students. The course has a strong emphasis on the ethical and regulatory issues in the digital credit ecosystem. Through an analysis of case studies and contemporary market practices, participants will get a deeper understanding of the trajectory of credit, enabling them to effectively navigate and exert influence in this ever-evolving area. This course is great for finance professionals since it gets students ready for leadership positions in the next wave of credit services. According to the “Future of Credit” course, from 2021 to 2032, there will be a 40% increase in fintech adoption, a 30% increase in credit evaluations, and a 20% growth in decentralized finance (DeFi).

Importance of Credit Course

Establishing a strong credit skills training program for workers can help enhance customer satisfaction while decreasing the likelihood of poor loan decisions. “Assessing the needs of an organization is essential when working to establish a credit training program,” Carlin stated. A good credit score can affect many aspects of your life, including your ability to rent or purchase a home, job prospects, loans, and more, so building a solid credit score now will pay dividends in the long run.

Why Choose Credit Course?

Choosing a credit course has various advantages, including the ability to obtain recognized qualifications that will boost your portfolio and contribute to your career advancement. Credit courses frequently feature planned curriculums to ensure comprehensive learning and mastery of the subject. They also give students access to expert professors and useful materials, allowing them to get a better knowledge. Additionally, credits acquired can be transferred to other educational programs, allowing for academic freedom and advancement. Finally, credit courses are a wise investment in your future.

Career Growth Investment Banking Course

A career as an investment banker, portfolio manager, or loan and trust manager may be attainable through this position. A credit analyst’s work might be demanding. It’s often your obligation to determine if an individual or business can afford a purchase and at what interest rate. A credit analyst with an associate degree may be allocated consumer assessment tasks, but analysts with a bachelor’s degree are assigned business credit evaluation obligations, as the latter demands a more in-depth understanding of credit functions. The number of credit courses in statistics is expected to grow dramatically between 2021 and 2030. As data-driven decision-making becomes more prevalent, the demand for statisticians and data analysts is predicted to increase by 35%.

A career as an investment banker, portfolio manager, or loan and trust manager may be attainable through this position. A credit analyst’s work might be demanding. It’s often your obligation to determine if an individual or business can afford a purchase and at what interest rate. A credit analyst with an associate degree may be allocated consumer assessment tasks, but analysts with a bachelor’s degree are assigned business credit evaluation obligations, as the latter demands a more in-depth understanding of credit functions. The number of credit courses in statistics is expected to grow dramatically between 2021 and 2030. As data-driven decision-making becomes more prevalent, the demand for statisticians and data analysts is predicted to increase by 35%.

CURRICULUM

Foundations of Credit

- An Overview of Credit System

- Categories of Credit Terms and Conditions

- Credit's Historical Evolution

- Important Figures in the Credit Market

Credit Analysis and Risk Management

- Analysis of Financial Statements

- Models of Credit Scoring

- Methods of Risk Assessment

- Normative Structures

- Monitoring and Evaluation of Credit

Advanced Credit Strategies

- Products with Structured Credit

- Derivatives of Credit

- Management of Portfolios Securitization

- Trends and Innovations in Credit

Practical Applications

- Case Studies

- Simulations of Industries

- Credit Data Analytics

- Moral Aspects to Take into Account

- Final Project