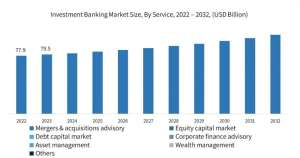

Investment bankers’ employment is expected to expand by 6% between 2022 and 2032, according to statistics. According to Merger market data, worldwide M&A agreements will exceed USD 4.8 trillion in 2023, indicating ongoing deal flow amid economic uncertainty. Investment banking is becoming an increasingly important tool for industry expansion and supporting economic progress in a variety of areas around the world as globalization advances. It is an excellent career choice because of its bright future in India and around the world. Investment banking has a highly outstanding role, thus anyone interested in establishing a career there should do so. Maximizing the potential of ambitious professionals’ skill sets.

Importance of Investment Banking Course

In essence, investment banks serve as a conduit between huge corporations and investors. Their key responsibilities include advising businesses and governments on how to address financial concerns and assisting them in obtaining finance, whether through stock offerings, bond issuance, or derivative products. One of the most major advantages of the Investment Banking Course is that it provides high-paying possibilities. Successful investment bankers can earn larger base salaries and commissions.

Why Choose Investment Banking Course?

The job market is improving for those interested in a career in investment banking. Individuals with the necessary degrees, connections, and experience can secure a number of high-paying positions in this industry. Strong analytical skills and market expertise will be in great demand among investment bankers. Investment banking is a rewarding career choice for those interested in money and financial services. An investment banker’s salary in India varies depending on their education and experience level.

Career Growth Investment Banking Course

Between 2017 and 2022, the investment banking sector in the United States grew at an average annual rate of 4.2%, with comparable trends elsewhere. The need for investment bankers is predicted to grow by 10% between 2018 and 2028. As technology progresses, cybersecurity will become increasingly important to the future of investment banking. Investment banking is being transformed by technology innovations, which require strong security measures to preserve customer information, forestall breaches, and ensure transaction integrity.

Between 2017 and 2022, the investment banking sector in the United States grew at an average annual rate of 4.2%, with comparable trends elsewhere. The need for investment bankers is predicted to grow by 10% between 2018 and 2028. As technology progresses, cybersecurity will become increasingly important to the future of investment banking. Investment banking is being transformed by technology innovations, which require strong security measures to preserve customer information, forestall breaches, and ensure transaction integrity.

CURRICULUM

Foundations of Investment Banking

- Introduction to Investment Banking

- Financial Markets and Instruments

- Principles of Corporate Finance

- Financial Accounting and Reporting

- Economics for Investment Bankers

Core Investment Banking Operations

- Mergers and Acquisitions (M&A)

- Equity and Debt Financing

- Valuation Methods

- Financial Modeling

- Due Diligence

Advanced Topics in Investment Banking

- Leveraged Buyouts (LBOs)

- Private Equity and Venture Capital

- Risk Management in Investment Banking

- Regulatory Environment and Compliance

- Ethics and Corporate Governance

Specialized Areas and Emerging Trends

- Structured Finance and Securitization

- International Investment Banking

- Technology and Innovation in Investment Banking

- Sustainable and Impact Investing

- Market Trends and Future Outlook