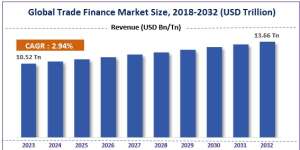

By 2023, the worldwide trade financing market will be worth $51.3 billion. Looking ahead, IMARC Group estimates the market to reach $82.7 billion by 2032, with a compound annual growth rate (CAGR) of 5.3% between 2024 and 2032. The market is expanding steadily due to increased international trade volume, the integration of artificial intelligence (AI) and data analytics to improve risk assessment, and the increasing complexity of the supply chain. The “Trade Finance Market” research report 2024 is a detailed and in-depth assessment of the industry’s segmentation by Types, Applications, and Regions. It discusses the key variables influencing market growth, as well as the current trends, opportunities, and concerns. The market’s CAGR status is presented, providing valuable information on the market’s performance over time. The Trade Finance Market study is a great resource for businesses, giving a complete overview of market dynamics, SWOT analysis, and future strategies to help them effectively map their path forward.

Importance of Trade and Finance Course

Trade finance refers to the financial mechanisms and goods used by businesses to facilitate international trade and commerce. Trade financing enables and facilitates business transactions between importers and exporters. Trade finance solutions are critical for international trade enterprises to succeed in the global marketplace. Trade finance enhances control over the import and export process by lowering risk, enhancing firm working capital, and enabling greater supervision of monies and documentation. Documentary collections, documentary credits, letters of guarantee, supply chain finance, and trade loans are all valuable trade finance options that help reduce nonpayment risk (for both importers and exporters), enable access to funding, and improve transaction visibility. Trade finance solutions are flexible, allowing them to match the needs of specific trading cycles while also delivering seamless worldwide trade transactions.

Why Choose Trade and Finance Course?

Trade finance seeks to simplify international trade while mitigating associated risks. Mitigating credit, foreign currency rate, and non-payment risks are among the trade finance services offered. Arrangements for letters of credit. Trade finance is a massive industry with excellent job opportunities. You can move between corporate banking roles, and if you are a specialist, even better. Trade finance specialists typically advance in the chain, and as they gain expertise, they are assigned larger and more important clients.

Career Growth Trade and Finance Course

Finance has always been a highly mobile industry, with more options for career seekers looking for foreign experience. The global financial services industry grew at a compound annual growth rate of 8.8% to USD28 trillion in 2023 and is expected to exceed USD37 trillion by 2027. Trade finance is a large vertical with promising job opportunities. You can move between corporate banking roles, and if you are a specialist, that’s ideal. Trade finance professionals typically advance up the chain, and as they gain expertise, they are assigned larger and more important clients.

Finance has always been a highly mobile industry, with more options for career seekers looking for foreign experience. The global financial services industry grew at a compound annual growth rate of 8.8% to USD28 trillion in 2023 and is expected to exceed USD37 trillion by 2027. Trade finance is a large vertical with promising job opportunities. You can move between corporate banking roles, and if you are a specialist, that’s ideal. Trade finance professionals typically advance up the chain, and as they gain expertise, they are assigned larger and more important clients.

CURRICULUM

Fundamentals of Trade and Finance

- Introduction to International Trade

- Global Economic Environment

- Financial Accounting Basics

- Business Mathematics for Trade

- Micro and Macro Economics

Core Trade Operations

- Export and Import Management

- International Logistics and Supply Chain Management

- Trade Finance Instruments

- Customs and Trade Regulations

- Risk Management in Trade

Financial Markets and Instruments in Trade

- Foreign Exchange Markets

- International Financial Markets

- Trade-Related Financial Instruments

- Corporate Finance for Trade

- Investment in Emerging Markets

Advanced Topics in Trade and Finance

- Global Trade Strategies

- International Trade Law

- Trade Policy Analysis

- Sustainable Trade and Finance

- Innovations in Trade and Finance