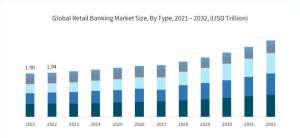

Financial institutions are adopting new technology and making significant investments in digital transformation programs. Automation and artificial intelligence are replacing human thinking, forcing organizations to reconsider their workforce landscape and the skills required to stay ahead of the curve. The Investment Banking worldwide Market Report 2022 forecasts a compound annual growth rate of 11.9% in 2022 and 10.4% in 2026, showing a considerable expansion of the worldwide investment banking business. The expected increase in the number is staggering.

Importance of Banking and Finance Course

Banking & Finance delves into the dynamic, fast-paced world of money, stocks, credit, and investments. Finance is an important aspect of our economy because it offers the liquidity in the form of money or assets needed for individuals and corporations to invest in the future. First and foremost, the banking sector is so varied that you can choose which segment of the banking industry you are interested in pursuing. It provides a fast-paced and consistently challenging career that will put your talents to the test. Second, taking a professional banking education offered by numerous banking institutions, government-registered organizations, and private enterprises would provide you with a lifetime employment chance. Banking and finance is one of those industries that will never go out of business and will continue to grow as the economy’s development activities expand.

Why Choose Banking and Finance Course?

First and maybe most importantly, because the financial industry is so diversified, you have always had the freedom to choose which area you are keen to follow. It offers a constantly demanding and fast-paced work environment that raises your skill level. The second advantage is that a number of financial institutions, government-registered businesses, and private sectors offer the chance to begin a lifetime profession by enrolling in specialized banking courses. The banking and finance industry is one that will undoubtedly continue to see growth and demand as more activities aimed at economic development are carried out.

Career Growth Banking and Finance Course

Projected job growth for statisticians between 2022 and 2032 is 31.6%, according to the Bureau of Labor Statistics. 10,500 positions should be expected to open during that time. Decision-making using data is a science that statisticians practice. Many employment prospects exist in the financial industry, contingent on your education, experience, skill set, and interests. You may take specific steps to make an impression on a hiring manager and assist you land a job, even if it can be a competitive sector. You can begin looking for and applying for these roles as soon as you’ve decided which financial positions are best for you.

Projected job growth for statisticians between 2022 and 2032 is 31.6%, according to the Bureau of Labor Statistics. 10,500 positions should be expected to open during that time. Decision-making using data is a science that statisticians practice. Many employment prospects exist in the financial industry, contingent on your education, experience, skill set, and interests. You may take specific steps to make an impression on a hiring manager and assist you land a job, even if it can be a competitive sector. You can begin looking for and applying for these roles as soon as you’ve decided which financial positions are best for you.

CURRICULUM

Foundation of Banking and Finance

- Introduction to Financial Systems

- Principles of Banking

- Financial Accounting

- Business Mathematics

- Economics for Finance

Core Banking Operations

- Retail Banking

- Corporate Banking

- Risk Management in Banking

- Banking Regulations and Compliance

- Digital Banking and FinTechInvestment and Financial Markets

Investment and Financial Markets

- Investment Principles

- Financial Markets and Instruments

- Corporate Finance

- Asset Management

- Behavioral Finance

Advanced Topics in Banking and Finance

- International Banking and Finance

- Financial Modelling and Analysis

- Ethics in Banking and Finance

- Strategic Financial Management

- Emerging Trends and Innovations